Which retail factors are making the biggest impact this year?

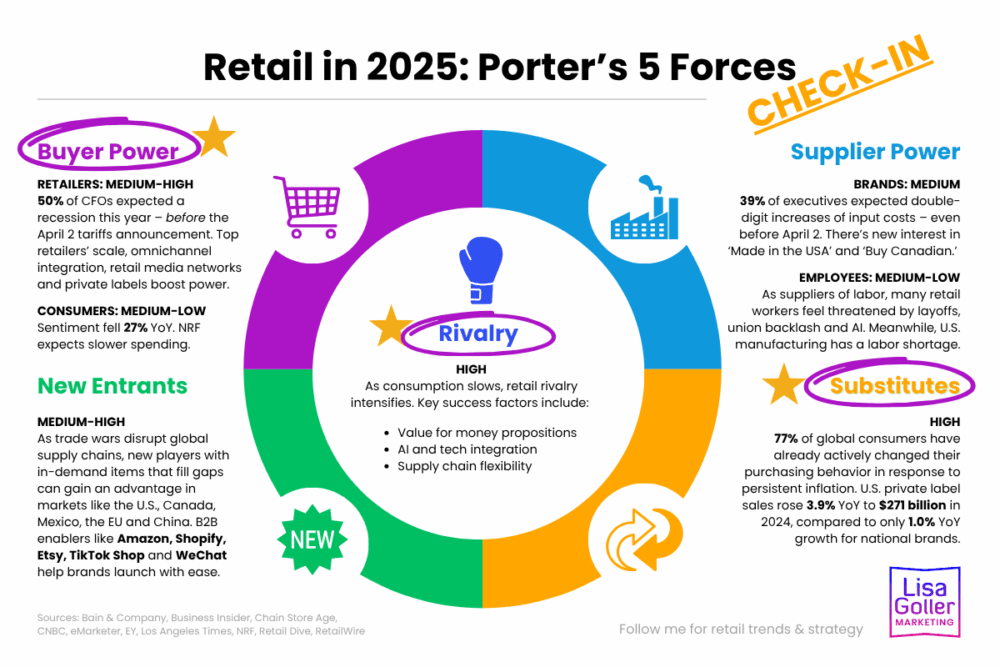

As promised, we’re revisiting our Porter’s 5 Forces framework from April to see which factors are actually influencing global retail stakeholders and strategy in 2025.

The following factors stand out the most.

BUYER POWER

Retail giants and high income households are navigating tariffs with relative ease

🏆 The biggest retailers are winning in a tariff economy [The Wall Street Journal]

📉 U.S. consumer confidence declines due to high prices, tariffs and the labor market [CNBC, Retail Dive, Yahoo]

📈 Conversely, wealthy consumers fuel retail, as the top 10% of earners drive a growing share of U.S. consumer spending [Bloomberg, CNBC]

SUBSTITUTES

Demand soars for private label as brand loyalty declines.

🔄 81% of Gen Z and millennial consumers have switched brands in the past year [eMarketer, Salesforce]

🥫 Amazon just launched Amazon Grocery private label and Aldi rebranded its private label assortment in time for the upcoming holiday feasts [Grocery Dive, RetailWire]

Private labels can help retailers grow their top line due to:

🛍️ Customer sales; and

📣 Retail media revenue

… as store brands may motivate national brands to spend more on advertising to stay competitive.

RIVALRY

AI proficiency helps retailers and their stakeholder groups stay agile and competitive.

🤖 Amazon’s new agentic AI tools will help sellers operate more efficiently [GeekWire, TechCrunch]

💪 Walmart x OpenAI partnership will empower Walmart workers [Retail Dive]

🛍️ ChatGPT now accounts for 20% of Walmart’s referral traffic [Modern Retail]

What other market factors stand out the most this year?

_______________________

🔔 Stay on top of the hottest retail trends:

Follow me on LinkedIn

Subscribe to my YouTube channel

_______________________

Related:

Retail in 2025: Porter’s 5 Forces (report from April 2025)

Retail in 2025: Porter’s 5 Forces highlights reel