How has retail power shifted?

This mid-year check-in shows some notable movements in recent months.

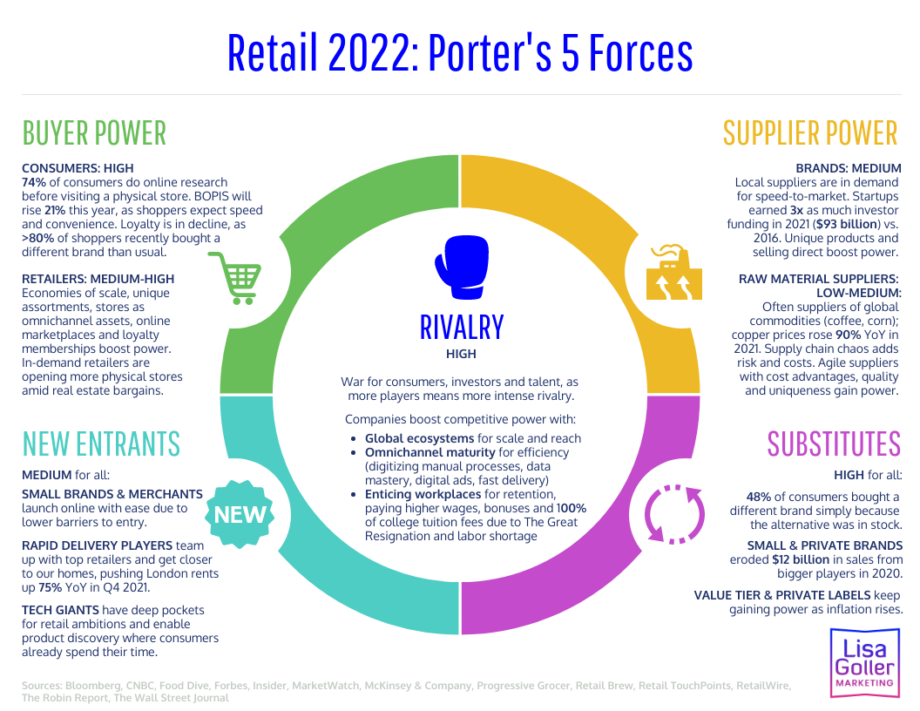

BUYER POWER

Consumers: Medium-High (vs. High in Jan.)

While we will see a summer of sales, inflation keeps eroding purchasing power

Retailers: Medium (vs. Medium-High in Jan.)

Inflation, supply chain chaos, lower spending and inventory gluts squeeze profitability

SUPPLIER POWER

NEW! If we view Employees as suppliers of productivity, there are mixed results.

The Great Resignation created a war for talent and unionization efforts. Yet, recent layoffs, store closures and reduced hiring reduce employee power.

SUBSTITUTES

Private Labels are even more in-demand as inflation increases the cost of living.

NEW ENTRANTS

Small Brands: Medium-High (vs. Medium in Jan.)

Domestic product sourcing, low barriers to entry and more business launches fuel small brands’ growth.

Rapid Delivery: Medium-Low (vs. Medium in Jan.)

As this market has contracted, leading players gain power through new partnerships.

RIVALRY

Competition is even fiercer, as retailers and brands battle to drive revenue, control costs and enhance the employee experience.

Which force do you think is most powerful today?

Related:

Retail 2022 – Porter’s 5 Forces (original post from Q1 2022)

2022 Retail PEST Analysis Mid-Year Check-In

One thought on “Retail 2022 – Porter’s 5 Forces Mid-Year Check-In”