Who has retail power right now?

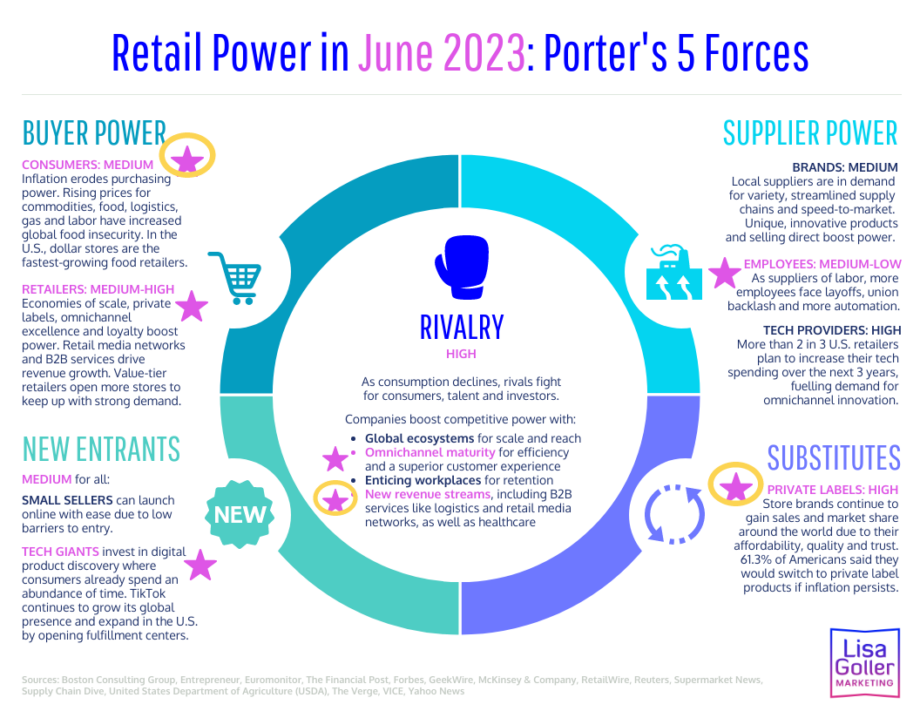

This mid-year review of Porter’s 5 Forces shows retail stakeholders have retained their respective levels of power since we first looked at this framework in January.

Stakeholder groups with purple stars – especially those circled in yellow – have made lots of headlines this year.

Here’s a brief overview that explains why.

🛍 BUYER POWER

Consumers: MEDIUM

Higher prices have led ~80% of consumers to cut spending on non-essential goods,and2 in 3 spend less on essentials, like groceries, utilities and gas. [CNBC]

💪 SUPPLIER POWER

Employees (as suppliers of productivity): MEDIUM-LOW

AI and robotics threaten jobs, and more companies expect workers to return to the office. [Retail Dive, The Washington Post]

🆕 NEW ENTRANTS

Tech giants: MEDIUM

TikTok focuses on global growth and Pintrest partners with Amazon for shoppable commerce. [Bloomberg, RetailWire]

🔄 SUBSTITUTES

🏷 Private label: HIGH

22% of European consumers plan to buy more private labels. [Forbes]

🏝 NEW! Non-retail spending: MEDIUM-HIGH

Entertainment and travel compete for consumers’ wallets. [NPR]

🥊 RIVALRY

📱 Omnichannel maturity: HIGH

Stores add tech, including retail media like Kroger’s digital screens and River Island’s use of RFID in fitting rooms [Retail TouchPoints, ZD Net]

💰 New revenue streams: HIGH

B2B services in tech, logistics and marketing drive growth [Retail Dive, RetailWire]

Who do you think has the most retail power right now?

Coming soon: We’ll look at the top retail trends that have made headlines in Q2 2023.🏝